*Sponsored content

Over the past decade, the tire industry has been reshaped by technological innovation, shifting consumer demand and an accelerating drive toward efficiency and sustainability. Global manufacturers have responded by consolidating production footprints and investing in modern facilities, while older but still highly capable factories are entering new phases of their lifecycle. For decision-makers in the sector, these transitions often present rare opportunities: not only to observe how industry giants adapt, but also to access world-class manufacturing equipment at a fraction of its original cost.

One such opportunity has now emerged in Fulda, Germany. For decades, Goodyear’s plant in the city has been a cornerstone of European tire manufacturing. With over 170,000m2 of production space, the facility specialized in high- and ultra-high-performance passenger car and SUV tires, including run-on-flat models and 4×4 applications. Its reputation for technical excellence and rigorous quality standards is well known in the market. Today, as Goodyear streamlines its European operations, the Fulda factory is opening a new chapter — this time as a source of premium equipment available to the wider industry.

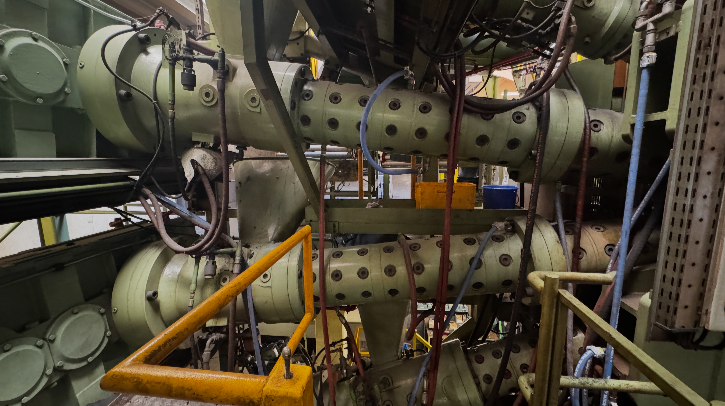

The scale of the assets being offered for sale is significant. The available surplus includes but is not limited to mixers, entire triplex and quadruplex extrusion lines, bead winder and extruder lines, cutter and tire building lines, as well as 77 tire presses. These are the backbone machines that enabled Fulda to produce tires across diameters ranging from 17in to 22in, serving a demanding segment of the automotive market. For companies seeking to expand production capacity, diversify product ranges or strengthen their technology base, the equipment represents a turnkey opportunity that would be almost impossible to replicate in today’s investment climate without enormous cost and lead time.

The sale is organized by Maynards Europe in conjunction with AllSurplus, combining decades of expertise in industrial asset management with a global online platform that reaches buyers across the manufacturing world. This dual approach ensures that the Fulda equipment can find new life in facilities where it will continue to generate value.

The process itself takes two forms. A Private Treaty Sale, running until the end of October, is dedicated to the core tire production equipment. This format allows interested parties to negotiate directly and secure key assets in a structured and confidential environment. In a second phase, an Online Auction will cover a broad range of workshop and factory equipment, giving a wider spectrum of buyers the chance to participate. Both avenues are designed to ensure transparency, accessibility and the efficient reallocation of machinery into productive use.

Beyond the practical details, the Fulda sale underscores a wider narrative about the tire industry today. As mobility trends evolve — toward electrification, digitalization and sustainability — manufacturers are under pressure to realign resources, upgrade production capabilities and focus on next-generation products. Yet this does not diminish the value of proven equipment. On the contrary, it highlights the resilience of these assets and the role they can play in strengthening mid-tier producers, supporting new entrants or complementing capacity in regions where demand for high-performance tires continues to grow.

For buyers, timing is critical. The window to act is limited, with the Private Treaty Sale closing at the end of October. Given the level of interest that equipment of this scale naturally generates, early engagement with Maynards Europe is strongly recommended. The company’s track record in managing large-scale industrial disposals means potential buyers can expect a professional process, detailed documentation and comprehensive support in evaluating and acquiring the assets most relevant to their needs.

Ultimately, the story of the Fulda factory is not one of decline but of transformation. The machinery that once produced millions of tires for European roads is ready to be redeployed, carrying with it a legacy of quality, precision and durability. For decision-makers across the tire industry, this is a chance to capture that legacy — and turn it into future growth.

The initial offering for the Private Treaty Sale will close on October 31, 2025, making early engagement essential. Companies interested in learning more about the available assets or participating in the process are encouraged to contact Maynards Europe at inquiry@maynards.com.